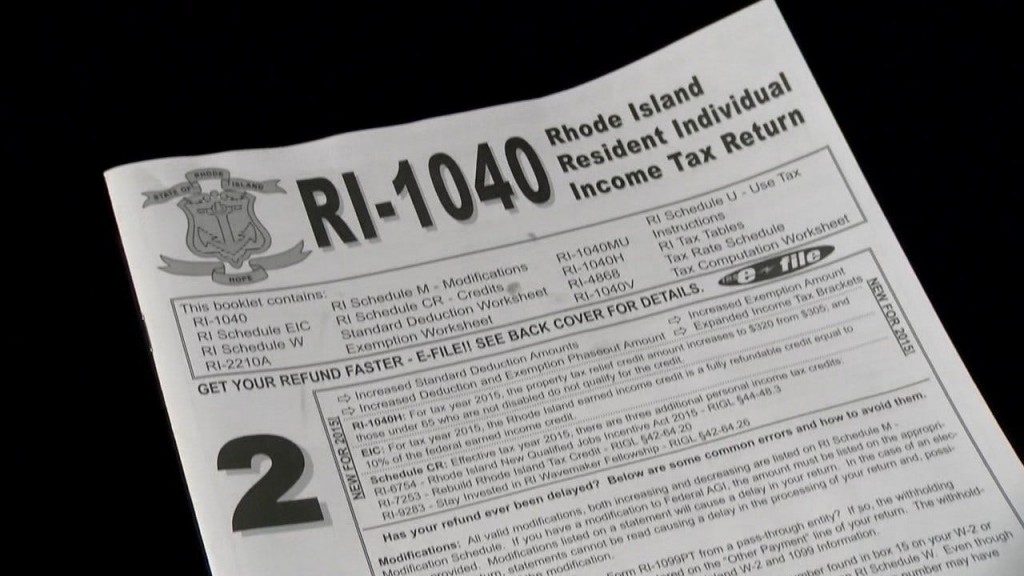

State Representatives Stepping In After Delayed Tax Returns

By Ana Bottary

abottary@abc6.com

@anabottary

Rafael Frometa has become quite familiar with the Rhode Island tax office at one Capitol Hill over the past few months.

"I’m still waiting on my taxes. This is the second time I came here and ask why. They say 2-3 weeks. I still wait," says Frometa.

He is not alone in the tax return waiting game.

"I filed my taxes in March, the beginning of march. I still haven’t received my return yet,"says Rhode Islander, Jimarl Tunstall.

State representative Patricia Serpa has stepped in to get to the bottom of it. As chair woman of the house oversight committee, she invited members of the department of revenue to give a presentation on what caused the delay. The Director explained if tax returns are identified as potentially fraudulent, it must be reviewed individually, saying fraudulent refunds have increased 84 -percent since 2015. He goes onto say 90 percent of returns are filed electronically leading to more filing errors. This year the department of revenue also rolled out a new computer system which they describe as complex. Despite their reasons, frustration from those waiting for returns continues.

"I have bills, I have children, yet no money," adds Tunstall.

According to the department of revenue, they expect all refunds from returns filed as of June 6 to be paid by mid-July. The acting tax administrator has also proposed legislation that would move up the filing deadline to enhance earlier fraud detection in 2017.

(c)WLNE-TV 2016